The US equities market is fragmented, with dozens of dark pools and exchanges offering hidden order types. Each operator finds something to love in its own pool, but skeptical observers have questioned how much unique liquidity, or unique value of any kind, the proverbial 31st dark pool really provides.

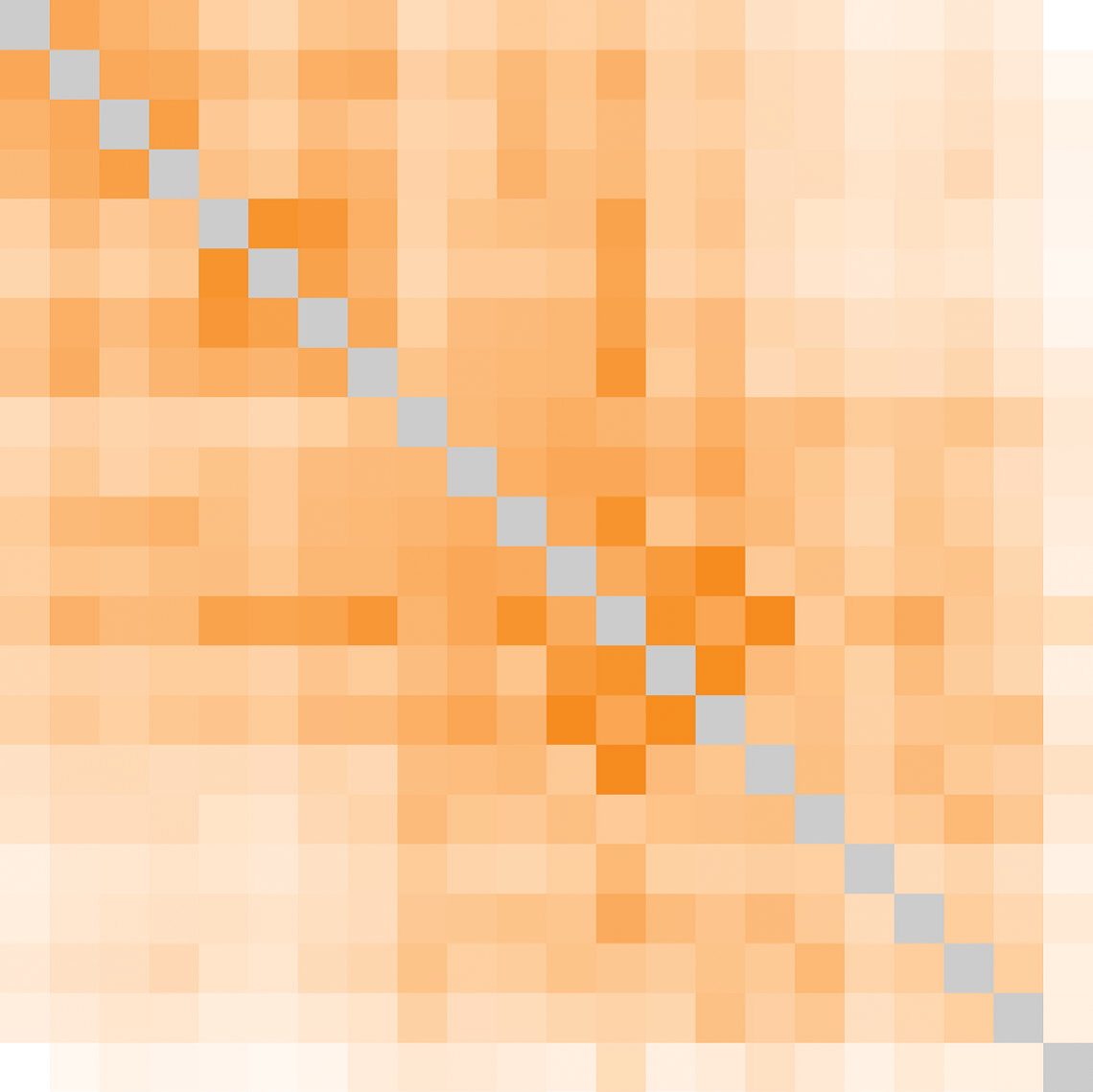

To begin to address this question, we analyzed correlations in midpoint liquidity across two dozen trading venues. If everyone effectively has access to all the dark pools—either directly or indirectly through trading intermediaries—there may be little benefit to accessing them all individually.

Contrary to the most skeptical view, our analysis shows that at the moderate time scale of a minute, venues matter. The strongest pattern shows that liquidity tends to cluster roughly into two groups, exchanges and dark pools, but there are additional idiosyncratic correlations between venues that suggest that having access to a broad range of dark pools provides practical value. Brokers who have not established a broad set of interconnections with other dark pools, or who favor their own dark pool to the exclusion of others’ may be missing liquidity.

You’re invited to read more about this in our latest research note, Liquidity Clustering in Dark Venues, available here.