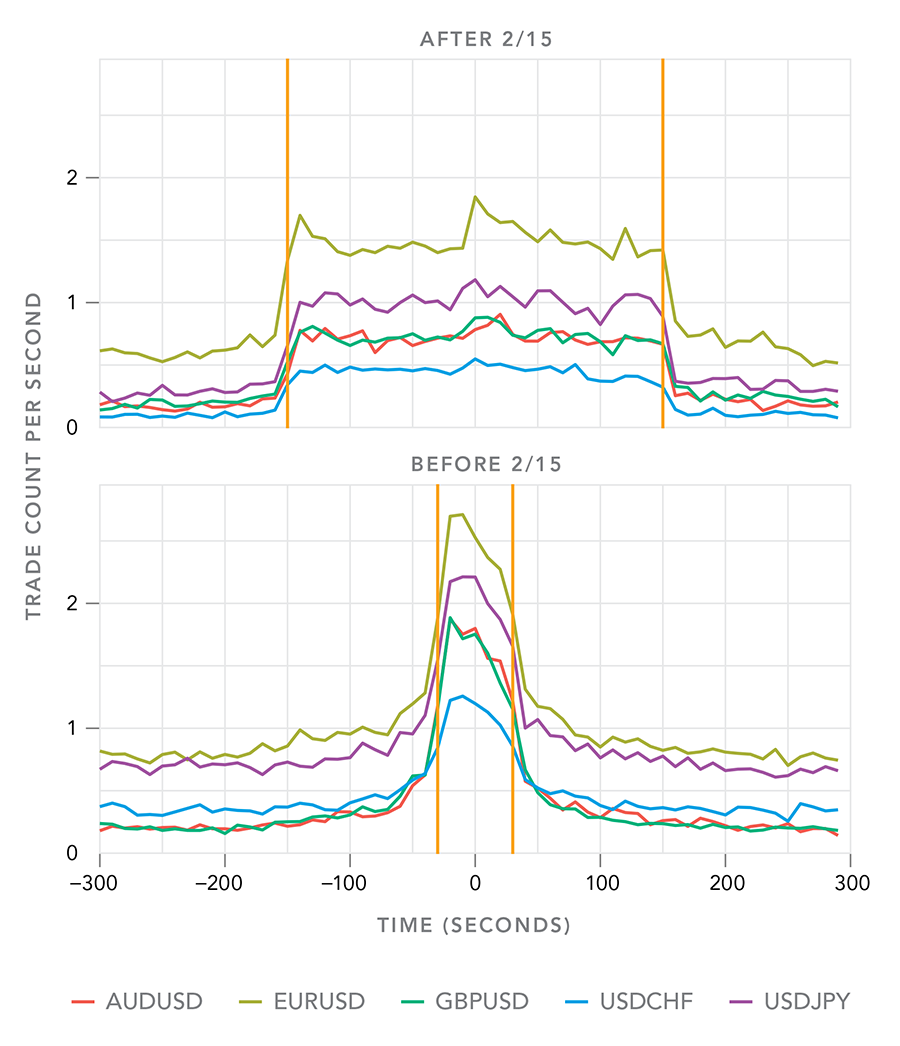

On February 15, 2015, WM/Reuters adopted a five-minute window to calculate its 4 p.m. currency benchmark rates, also known as the Fix. This change, in conjunction with the industry’s reported shift toward automated handling of Fix orders, has created new patterns in currency trading around the Fix.

Anecdotal reports suggest that banks are shifting away from handling Fix orders as principal trades on the spot desk toward agency-style execution, specifically time weighted average price (TWAP) algorithms that trade steadily during the five-minute Fix window. The systematic concentration of demand imbalances during this five-minute interval has created strong momentum in rate changes throughout the Fix window, followed by a marked reversion. This pattern allows firms to improve trading performance relative to the Fix without private information.

Read all about it in our latest research note, available HERE.