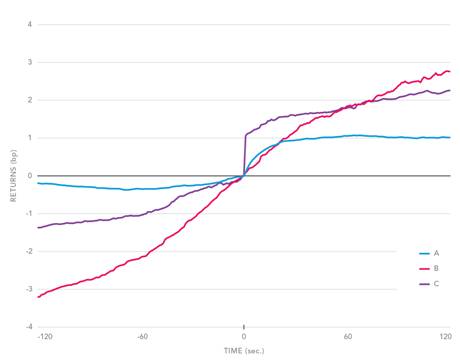

Pragma’s new research note discusses some deep challenges in the buyside’s effort to understand which trading venues provide the best execution quality, and whether brokers are routing their orders appropriately. The challenge is fundamental: the data that buyside clients currently receive from their brokers regarding where orders were filled is simply inadequate for the purpose of evaluating the quality of the venues that brokers route child orders to, or the quality of brokers’ routing policies.

This research note has a connection to three recent news stories.

First, as reported by the WSJ and Bloomberg, is that the SEC is considering reforming the maker-taker pricing model, or conducting a pilot to evaluate.

The reason this interests the SEC is that brokers face conflicts of interest when handling virtually every share for an institutional client, many of which are created or exacerbated by the maker/taker model, as we briefly review in the research note, and as we have explored in more detail in previous research notes, To Hop (the Queue), and Inherent Conflicts in the Maker/Taker Model.

In addition, large rebates create distorted incentives for liquidity providers, paradoxically degrading execution quality for directional traders who would like to trade patiently, as explored in Pragma research note, The Difficulty of Trading Ultra Liquid Stocks, and the commentary HFT and the Hidden Cost of Deep Liquidity.

Second, the SEC is reportedly considering requiring greater disclosure by brokers of the details of their order routing – where and when they route client orders, not just where orders are ultimately filled.

Regulatory action requiring full disclosure would be beneficial precisely because of the challenges described in the present Pragma research note: fills alone are not enough to understand venue quality. The full detailed dataset of all child orders sent on behalf of a client – filled and unfilled – begins to provide a much richer view and ability to evaluate venues and brokers, though it is still an extremely technically challenging task.

On the flip side, the SEC is considering a less onerous requirement as well – requiring disclosure of high-level statistics about routing in a uniform format. However, as the present Pragma research note suggests, such high-level disclosures would not provide a great deal of value to clients because of the difficulty of evaluating whether the routing policy that generates those statistics actually helps or hurts the client.

Finally, the inescapable Flash Boys. The book asserts that HFTs use latency advantages to prey on institutions, and that IEX, a new trading venue, can neutralize those advantage through rules and technical design. The research note shows why it will be difficult for the buyside to validate that proposition using conventional venue analysis.