High Touch Desks Get Best-Ex Due Diligence

The buy side is closing a major gap in its best-execution due diligence: The order routing practices of high-touch trading desks are falling under intense scrutiny previously reserved for self-directed trading tools. This increased attention presents a major challenge for brokers who use a variety of low-cost algorithms from multiple providers, since they have limited knowledge of how those algorithms route orders, let alone control over their behavior. Fortunately, independent algorithmic technology providers like Pragma offer a solution.

A series of broker scandals over the past several years has rocked the buy side. The SEC has levied fines against Pipeline, Level, Barclays, UBS, ITG, and Credit Suisse, either for failing to do what they said they had done or for doing things they shouldn’t have while handling client orders, generally around their ATSs. The SEC has proposed Reg ATS-N to require more granular disclosure of ATS rules and behavior.

Meanwhile, the media has focused more attention on the conflicts of interest brokers face when routing client orders. Due in part to pressure from the buy side, limiting or eliminating maker-taker exchange pricing – a major source of conflict – is near the top of the SEC’s list of potential market structure changes.

In this climate, buy-side trading desks have dramatically increased their scrutiny of how brokers are routing and handling their orders, demanding in-person meetings and sending in-depth questionnaires that historically focused only on self-directed algorithmic orders. The most sophisticated firms are delving as deeply into high-touch routing and order handling practices as they do with low-touch orders.

This increasing diligence is appropriate. Despite the growth of self-directed algorithmic trading over the past decade, high touch trading still accounts for two thirds of institutional trading volume in US equities.[1] Ultimately most high-touch order flow also ends up being traded algorithmically, and algo routing logic can compromise execution quality for high-touch trades in the same ways as self-directed trading. Yet order handling on high-touch desks has been a blind spot for the buy side. This blind spot is shrinking, however, as buy-side firms extend their due diligence efforts to how brokers handle and route their orders from high-touch desks – and many brokers are ill-prepared to answer their questions.

This trend presents a much greater challenge to research brokers and mid-tier brokers than to bulge brackets and algorithmic specialists. Bulge-bracket brokers typically use their own algorithms on their high-touch desks. They also must justify order routing decisions, particularly those involving their own ATSs. However, since they have built the algorithms and smart order routers that make those routing decisions, the bulges are able to provide granular detail about their order routing practices and to adjust them when the buy side requires it.

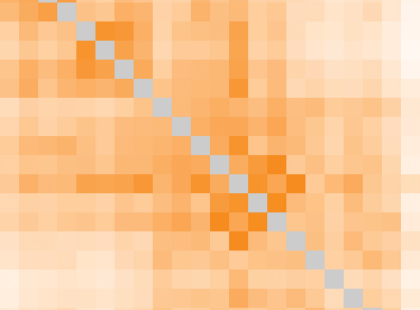

In contrast, most other brokers use a hodge-podge of algorithm suites, most often provided by a combination of bulge brackets and high-frequency trading firms. Because these algorithmic brokers offer little transparency into their algorithms, the brokers using them don’t have a granular understanding of their own routing practices, for example why an order gets routed to a given provider’s ATS as opposed to another venue. Even if they could explain the routing rules for one algorithmic suite, brokers commonly use algorithms from up to a dozen different algorithmic brokers, adding up to hundreds of individual algorithms. So any coherent or comprehensive understanding of a broker’s own effective routing practices is practically impossible, as is the ability to answer the types of in-depth questions asked in the course of buy-side best-execution due diligence.

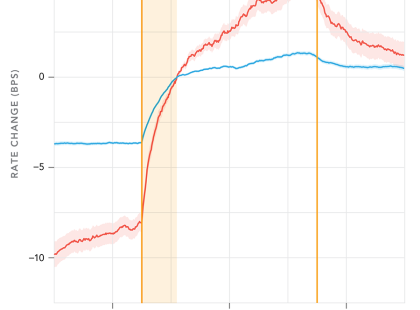

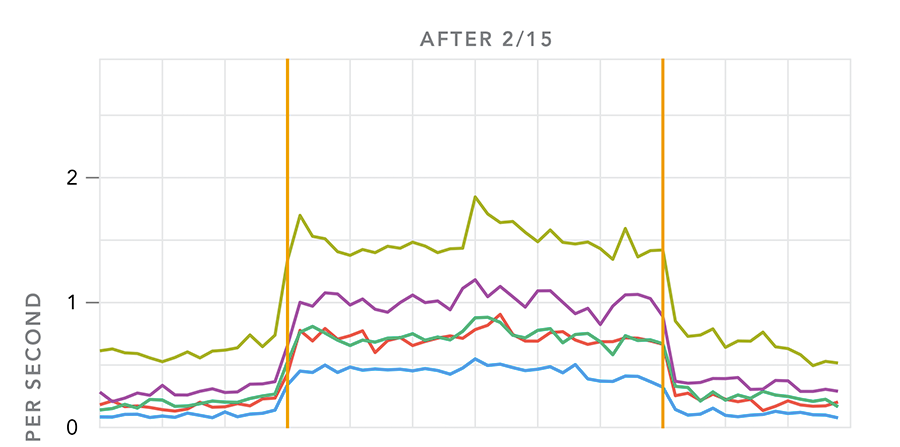

Furthermore, to the extent it occurs, due diligence into high-touch routing practices often reveals an unsettling picture. Cost is a major factor for most brokers in selecting the algorithms they use, and algorithmic services can be had for a very low fee, sometimes even “free.” But nothing is truly free. Low-cost, white-labeled algorithms are subsidized by the algo provider’s use of that order flow to generate profits, and the techniques they use can compromise execution quality. For example, an algorithmic broker’s “cost router” – typically used for other brokers and for the least performance-sensitive clients – generates revenues by feeding the provider’s dark pool or through aggressive use of limit orders to generate rebates. As an extreme example, one algorithmic broker uses “net pricing” to subsidize their broker clients’ algorithms. In this practice, the provider deliberately price disimproves executions on these orders to generate proprietary trading profits.[2] The broker client passes the real cost of the algorithmic service back to the buy side in degraded execution quality.

Thus, not only are most brokers not able to answer their customers’ questions about routing practices, they are – perhaps without fully realizing it – exposing their customers’ orders to some of the worst routing practices in the industry. Over the past several years, Pragma and other industry and academic commentators have detailed the conflicts brokers are exposed to in choosing between explicit costs to themselves and implicit costs to their customers. Given this industry and media attention, brokers who maintain a don’t ask, don’t tell attitude toward best execution may be exposing themselves to much larger long-term costs by putting customer relationships at risk.

Conversely, this situation creates an opportunity for brokers to differentiate themselves from their peers and capture more revenue by providing a high-quality execution solution that addresses their customers’ need for transparency around routing and order handling to satisfy their best execution obligations.

Until now, such differentiation has been far out of reach for most brokers. Few outside of the bulge bracket have attempted to build their own algorithmic offerings. Building an algorithmic product requires the specialized expertise of software developers and “quants.” These teams are expensive, difficult to hire, and difficult to manage. The project is a huge expense – typically many millions of dollars – with substantial risk of failure and significant time lag before a new product can get to market. The industry is full of horror stories of failed projects, even at large banks with the resources, culture, and expertise to hire and manage such teams, which most brokers simply do not have. Maintaining these offerings over the years also costs million dollars per year, though the cost of failing to maintain them properly can be even greater.

However, there is now a practical solution. Pragma360 is a turnkey algorithmic trading platform that allows a broker to effectively have its own algorithmic product that it can use on its high-touch trading desks and push out as a low-touch electronic service to its buy-side customers. Because Pragma acts as an outsourced technology provider rather than an executing broker, its broker customers select and clear directly with their counterparties, and they have full transparency into their order routing practices. Pragma offers advice based on its experience and quantitative research, and handles implementation, but ultimately the broker has control and can customize its algorithmic suite in order to provide the best trading experience for its customers. This control means that brokers can demonstrate their commitment to best execution not only by meaningfully discussing their routing policies, but by customizing them if requested by a buy side customer. For example, Pragma’s customers have been early participants in industry initiatives like TABB Metrics Clarity, which provides the buy side with in-depth analytics around brokers’ routing – and IEX, an ATS seeking SEC approval to become a registered exchange.

In conclusion, brokers are already experiencing more in-depth due diligence into high-touch desk order routing practices, and must anticipate increasing scrutiny both from the buy side and from regulators. This creates both a challenge to brokers’ desire to be meaningful trading partners to the buy side, and an opportunity to separate themselves from their competitors. While the costs and business risk of building a new algorithmic offering can be prohibitive for individual firms, independent algorithmic technology providers like Pragma offer a solution. Pragma allows brokers to provide a highly customized product on top of proven algorithmic trading technology, which is a model that has been widely accepted by the buy side. This approach not only offers full transparency and control over order routing practices that will satisfy increasing due diligence from the buy side, but it also allows brokers to create a unique client-facing algorithmic offering in a manner until recently was available only to the bulge brackets and algorithmic specialists.

[1] https://www.greenwich.com/press-release/growth-stalls-us-equity-etrading

[2] http://www.bloombergview.com/articles/2015-08-14/making-itg-s-secret-dark-pool-trading-desk-even-murkier

Read more